Your generous support of JA British Columbia will go to providing life-changing work readiness, financial health and entrepreneurship programs to youth in urban, rural and Indigenous communities across British Columbia.

Ways to Give:

Give as a Corporation

Make a tax-deductible donation as a business or corporation. Contact Nancy or donate below.

All donations receive a tax receipt

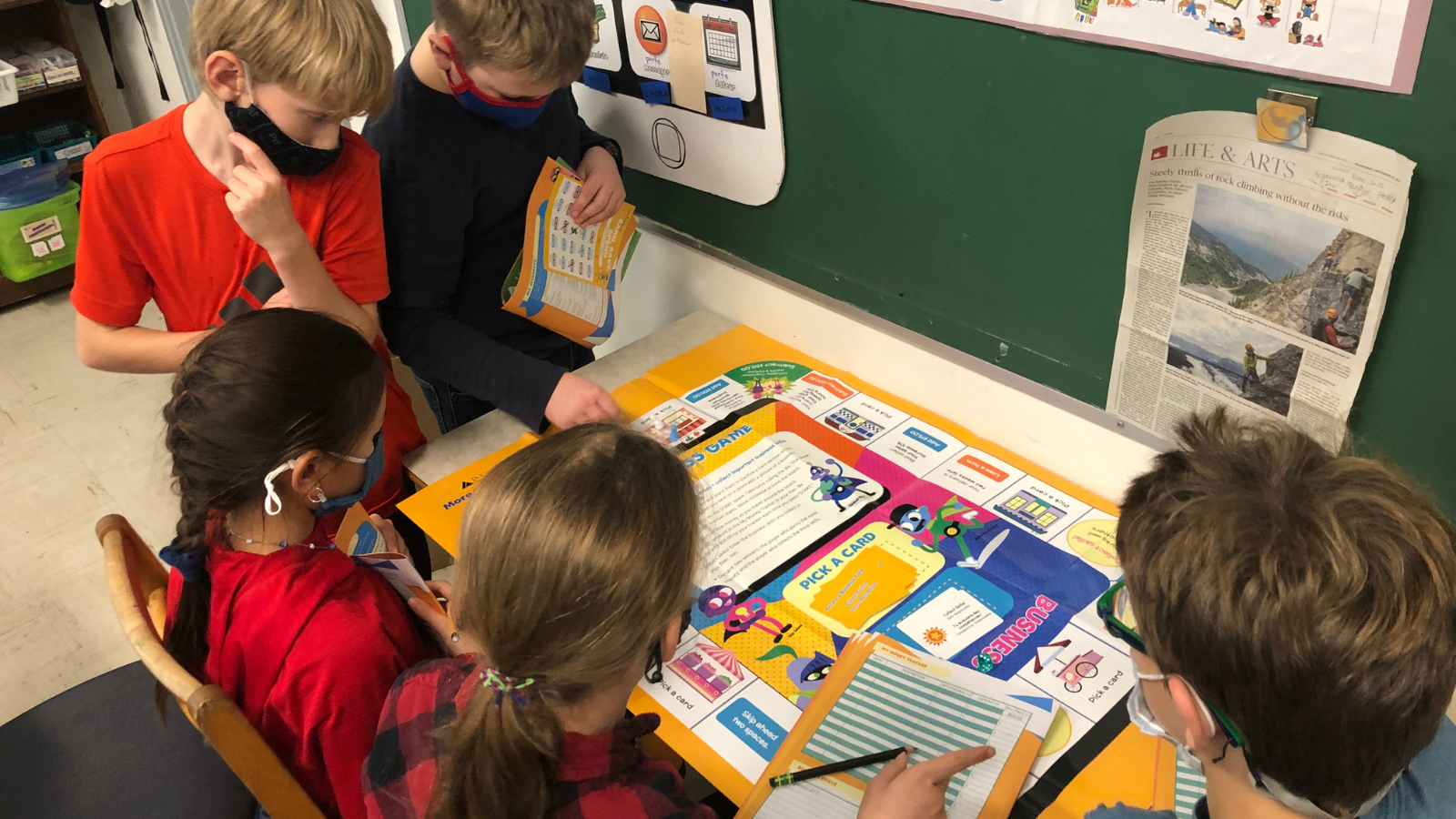

Thanks to our generous donors and sponsors, JA’s life-changing work readiness, financial health and entrepreneurship programs are delivered free of charge to British Columbia youth in grades four to 12. Charitable donations receive a federal and a provincial charitable tax credit, with an increasing return on larger gifts.

Want to send us a general donation?

Fantastic! Please address it to:

JA British Columbia #360 475 West Georgia St. Vancouver, B.C. V6B 4M9. Attention: Nancy Cardozo, Vice President, Development.

Further questions?

Please contact:

Nancy Cardozo, Vice President, Development, at: 604.688.3887 ext. 229 or Nancy.Cardozo@jabc.org

“Because of the JA Dollars with Sense program, I learned how to be careful when buying stuff online, how to save money and get more money!”

“Thank you, JA British Columbia! JABC has been incredibly supportive since 2019, and getting to learn about entrepreneurship with the help of the Company Program was an amazing way to improve my business literacy, exercise my creativity, and have fun! The confidence that I had gained and the wonderful people that I had met made it an invaluable experience that I hope many other young people get to take part in.”

“The presentation gave us a clear understanding of how life after post-secondary education might look like. Since I’m new to Canada, I didn’t really know how a lot of things worked and it was all alien to me. But now I have a basic idea of living costs if I decide to move out and of college/university/apprenticeship options. I loved it!”