Change lives in your community through charitable gift planning.

A planned gift is committed now, and can be celebrated now, but actually doesn’t take effect until the future. Through a planned gift to JA British Columbia, you can make a significant difference in the lives of others tomorrow, with little or no effect on your finances today. Donors who inform us of their plans are considered members of our Legacy Circle with personalized opportunities for involvement and public or private recognition.

There are many ways to leave a planned gift. For your consideration, here are three of the easiest ways:

Bequest in your Will

Direct money, an asset or some estate to JABC.

Gift of Life Insurance

Name JABC as the beneficiary of your life insurance policy.

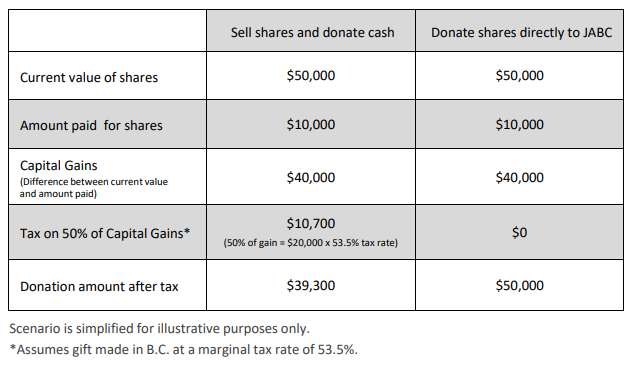

Gift of Stock or Securities

Give appreciated stocks or securities as an alternative to a cash gift.

![]() When you remember JABC with a planned gift, you will make a lasting contribution to youth education in British Columbia. Planned gifts help us with ongoing programming costs that will benefit the next generation of business leaders.

When you remember JABC with a planned gift, you will make a lasting contribution to youth education in British Columbia. Planned gifts help us with ongoing programming costs that will benefit the next generation of business leaders.

We are extremely grateful to everyone who considers leaving a planned gift to JABC.

When making the beneficiary designation, the correct legal name and address to use is:

Junior Achievement of British Columbia

#360 – 475 West Georgia Street, Vancouver, B.C. V6B 4M9

Charitable Business Number: 11897 6166 RR0001

Contact Us

To speak to us about your planned gift, please contact Nancy Cordozo at 604-688-3887 ext 229 or nancy.cardozo@jabc.org